500,000

UK shoppers (and growing)

1,000+

UK retailers use Super

1.3x

Super members shop more

As featured in

See for yourself how much you could save

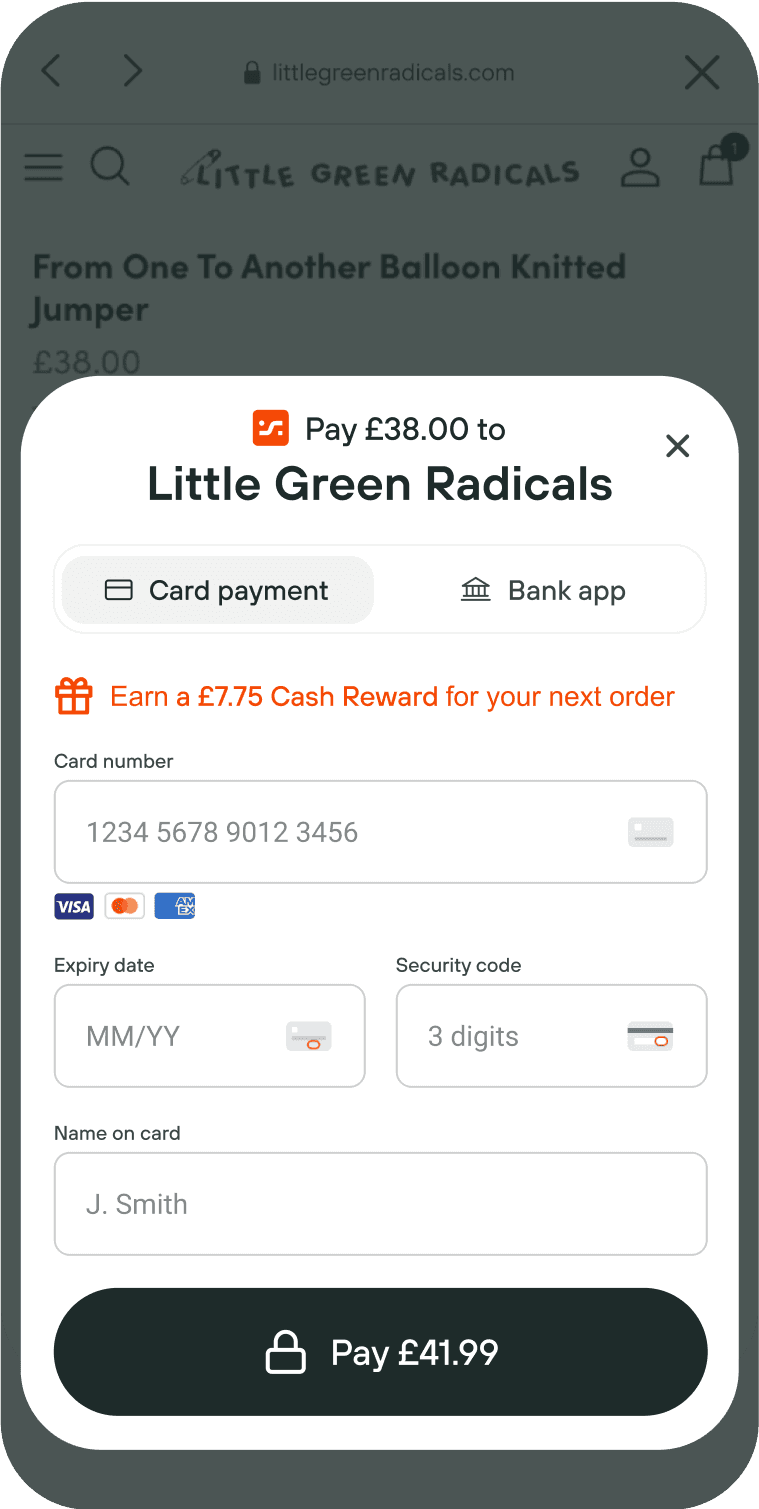

Accept card payments for free

0% payment fees

Best-in-class user experience

Industry-leading fraud protection

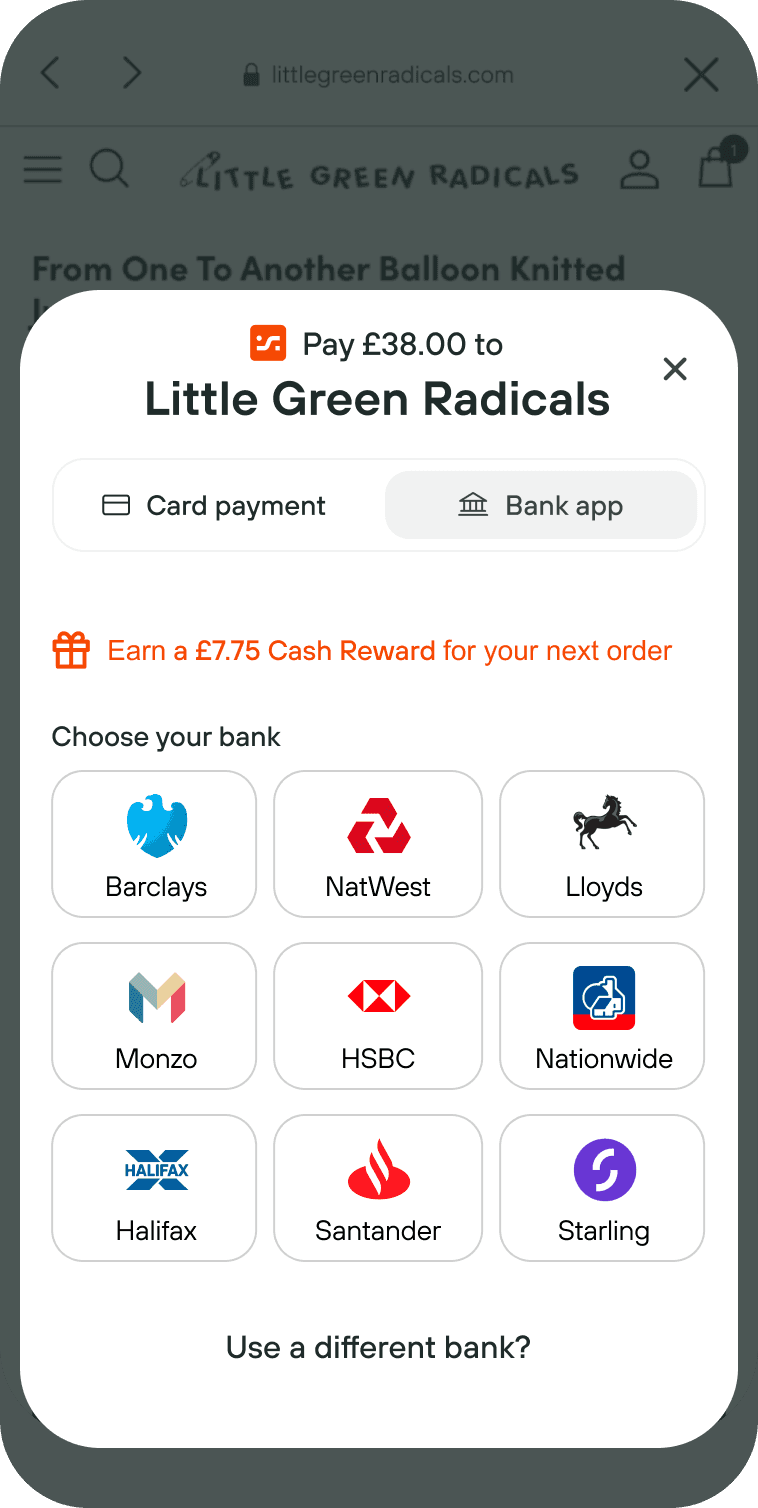

Accept open banking payments for free

Compatible with all major banking platforms

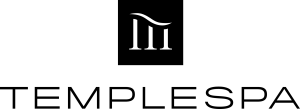

Acquire new customers

We will bring you new customers from the Super network of shoppers. You only pay if they make a purchase on your website.

Maintain full control over your Cost Per Acquisition (CPA), with a proportion given to the new customer towards their first purchase.

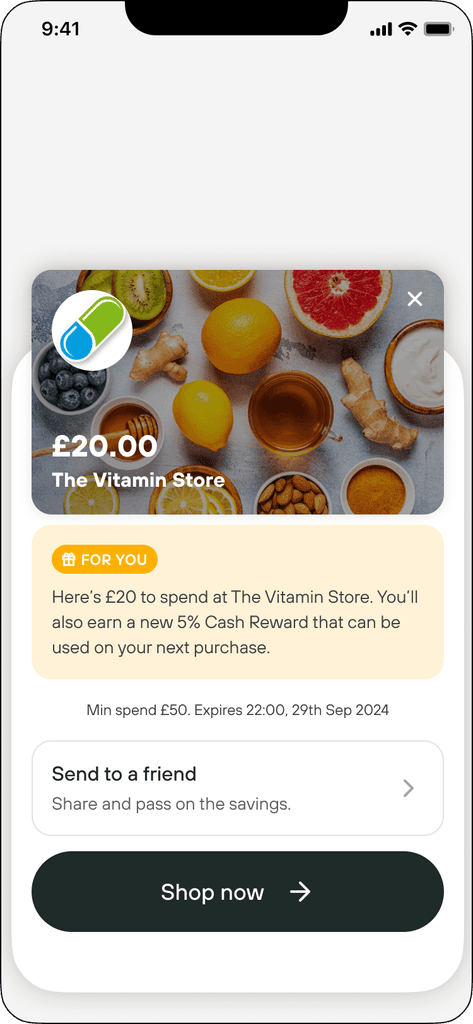

Retain: your customers will shop 1.3x more

Offering Cash Rewards to your customers with every Super payment encourages repeat purchases. These rewards are exclusive to your store and Super members typically buy 1.3 times more. If they don't return, you pay nothing.

Super is integrated with all major ecommerce platforms

The Super API caters for custom ecommerce integrations. We will support your business in getting up and running with dedicated tech support.

Our team has delivered a seamless, secure, scalable platform that puts both merchant and consumer at the centre of everything we do.

FAQ

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?