500,000

UK shoppers (and growing)

1,000+

UK retailers use Super

1.3x

Super members shop more

A radically better payment company

Super powers free payments for businesses and more rewarding shopping for customers, so that everyone wins.

Super saves you money

Payments used to be free. We think they should be again. So we’ve built a modern payment network to give you 0% payment fees, forever.

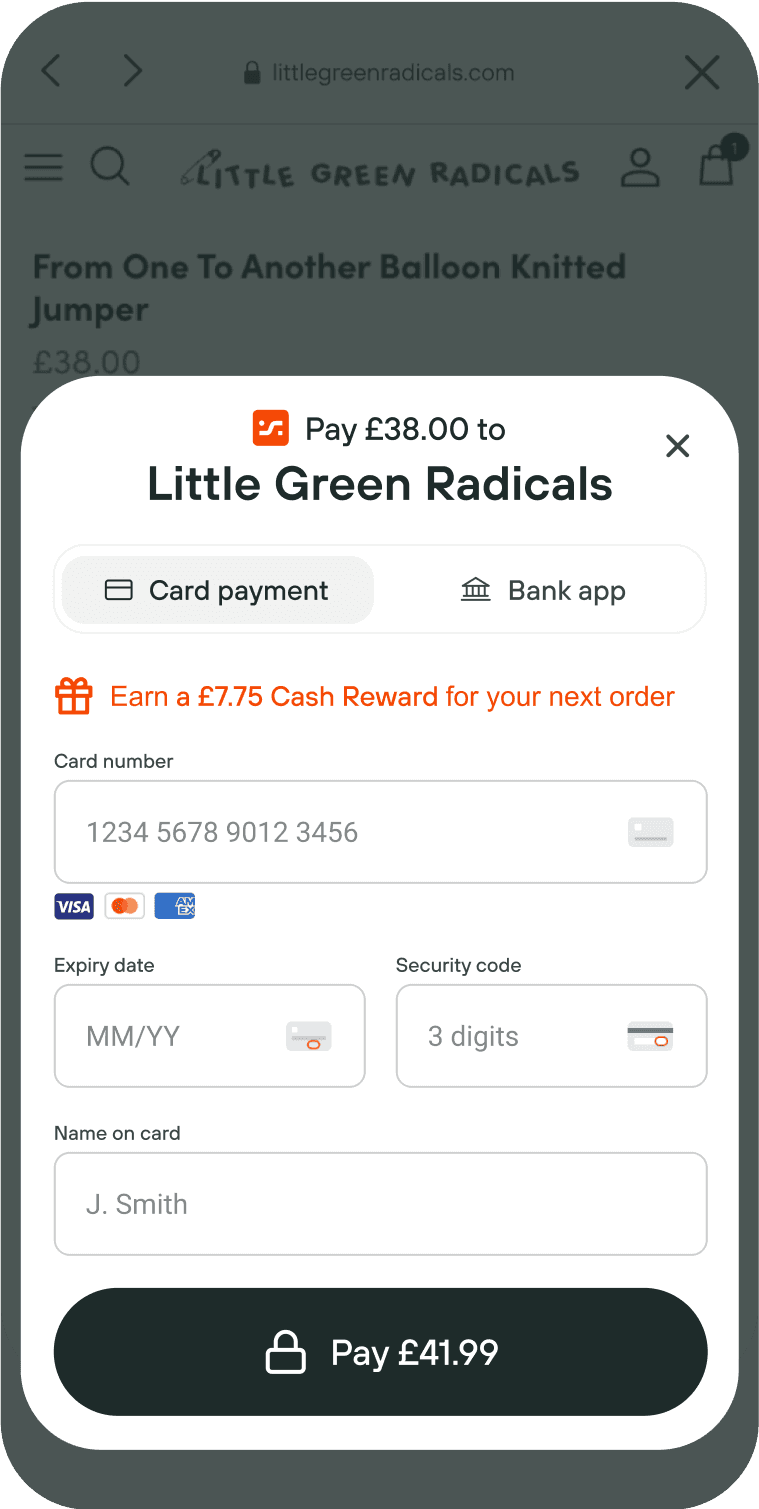

Super increases your sales

You can offer a Cash Reward to your customers, that can only be used at your store when a customer buys from you again. When you offer Cash Rewards, Super members buy 1.3x more from you. If they don’t buy again, it doesn’t cost you a penny. It's a win-win.

As featured in

See for yourself how much you could save

Accept card payments for free

0% payment fees

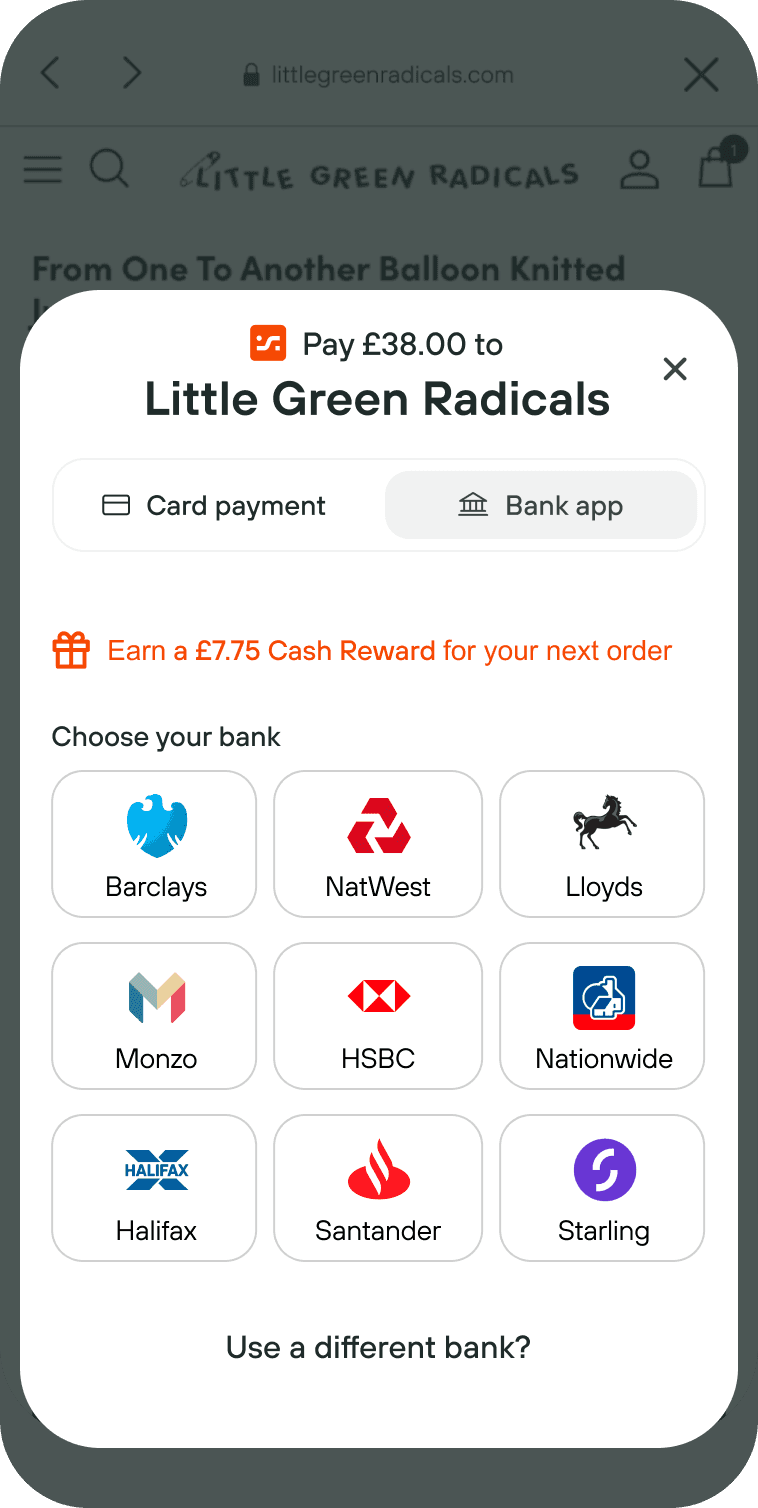

Best-in-class user experience

Industry-leading fraud protection

Accept open banking payments for free

Compatible with all major banking platforms

With Super your customers shop 1.3x more

Offering Cash Rewards to your customers with every Super payment encourages repeat purchases. These rewards are exclusive to your store and Super members typically buy 1.3 times more. If they don't return, you pay nothing.

Super is integrated with all major ecommerce platforms

The Super API caters for custom ecommerce integrations. We will support your business in getting up and running with dedicated tech support.

Our team has delivered a seamless, secure, scalable platform that puts both merchant and consumer at the centre of everything we do.

FAQ

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?