Super Payments

Super Payments

Super

Payments

Super Payments is a next-generation payment solution that eliminates fees and boosts customer loyalty.

Super Payments is a next-generation payment solution that eliminates fees and boosts customer loyalty.

Let your customers check out seamlessly while you keep 100% of your revenue. No fees, no friction – just a better payment experience for you and your shoppers.

Let your customers check out seamlessly while you keep 100% of your revenue. No fees, no friction – just a better payment experience for you and your shoppers.

Zero fees, forever.

0% transaction fees across credit and debit cards.

Super

Visa & Mastercard

0%

1.2% + 30p

UK corporate cards

0%

2.9% + 30p

UK pay by bank

0%

1.2% + 30p

EU cards

0%

2.49% + 30p

Time to receive money

7 days

Next day

Super offers a range of optional paid add-ons that can be switched on and off at any time. Certain non-standard payments are subject to additional fees.

Read more: Super's Business Pricing and Super's Payout Scheduling.

Zero fees, forever.

0% transaction fees across credit and debit cards.

Consumer UK Visa

& Mastercard

Consumer UK Visa

& Mastercard

& Google Pay

Apple Pay

UK corporate cards

UK pay by bank

EU cards

Time to receive money

Time to

receive money

0%

0%

0%

0%

0%

Next day

Other providers

Other providers

1.2% + 30p

1.2% + 30p

1.2% + 30p

1.2% + 30p

2.9% + 30p

2.9% + 30p

1.2% + 30p

1.2% + 30p

2.49% + 30p

2.49% + 30p

2-3 days

2 days

Super offers a range of optional paid add-ons that can be switched on and off at any time. Certain non-standard payments are subject to additional fees.

Read more: Super's Business Pricing and Super's Payout Scheduling.

Zero fees, forever.

0% transaction fees across credit and debit cards.

Super

0%

UK pay by bank

0%

EU cards

0%

Time to

receive money

Next day

Other Providers

1.2% + 30p

1.2% + 30p

UK pay by bank

1.2% + 30p

EU cards

2.49% + 30p

Time to

receive money

2-3 days

0%

Super offers a range of optional paid add-ons that can be switched on and off at any time. Certain non-standard payments are subject to additional fees.

Read more: Super's Business Pricing and Super's Payout Scheduling.

Zero fees, forever.

0% transaction fees across credit and debit cards.

Consumer UK Visa

& Mastercard

& Google Pay

Apple Pay

UK corporate cards

UK pay by bank

EU cards

Time to receive money

0%

0%

0%

0%

0%

Next day

Other providers

1.2% + 30p

1.2% + 30p

2.9% + 30p

1.2% + 30p

2.49% + 30p

2-3 days

Super offers a range of optional paid add-ons that can be switched on and off at any time. Certain non-standard payments are subject to additional fees.

Read more: Super's Business Pricing and Super's Payout Scheduling.

Why choose Super Payments?

0% transaction fees: Stop paying payment processing fees.

With Super, you keep every penny of each sale – there are absolutely no card or bank payment fees, ever. Say goodbye to 1–5% charges eating into your margins.

Secure & Compliant

payments

Your transactions are in safe hands with Super. We are authorized by the FCA (Financial Conduct Authority) and comply with all relevant payment regulations.

We’re partnered with Stripe and Yapily, so you’ll have world-class security and support from your very first payment.

Fast settlements

Enjoy reliable cash flow with quick settlements to your bank account. Get paid every day (for free), with the option to receive instant payouts if you require faster access to funds.

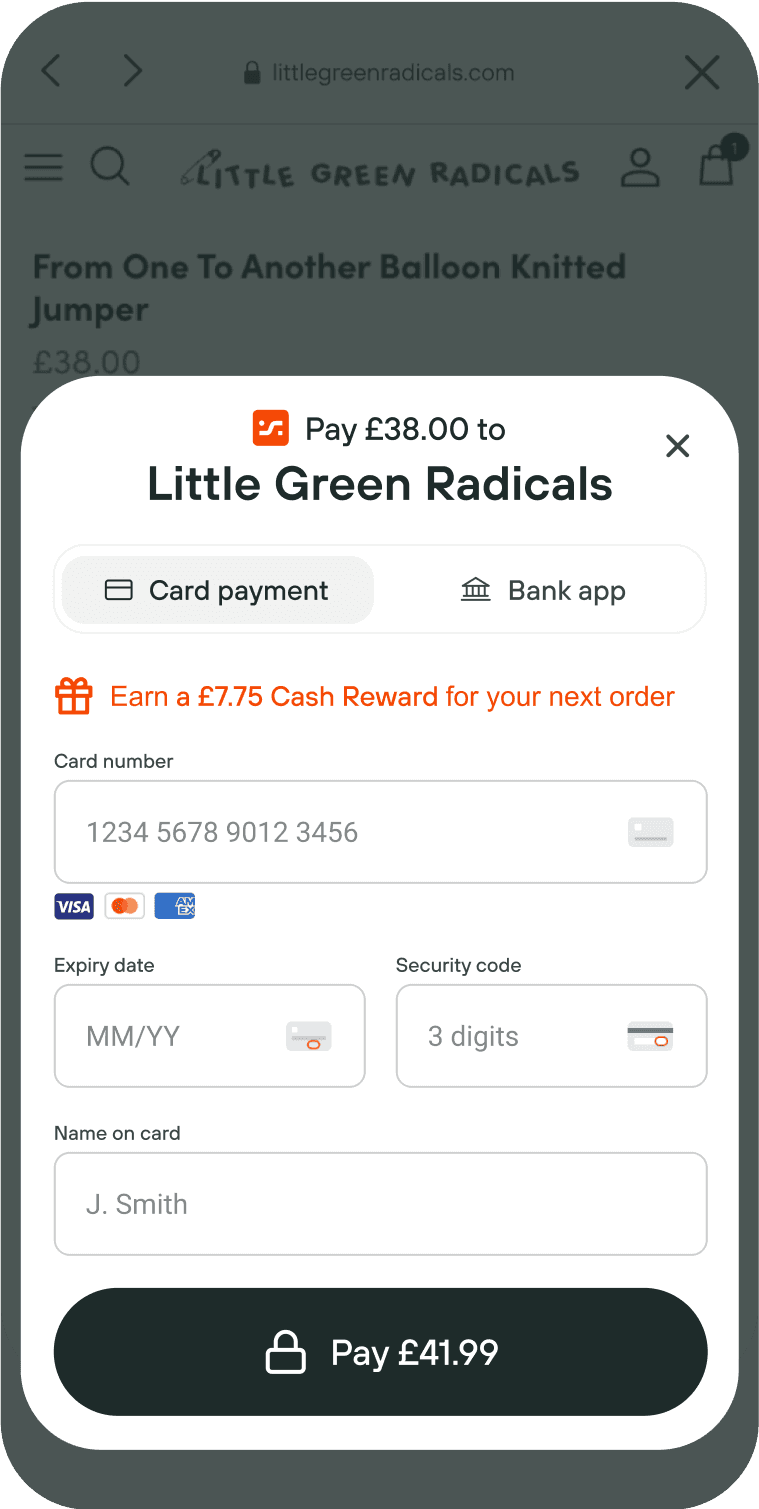

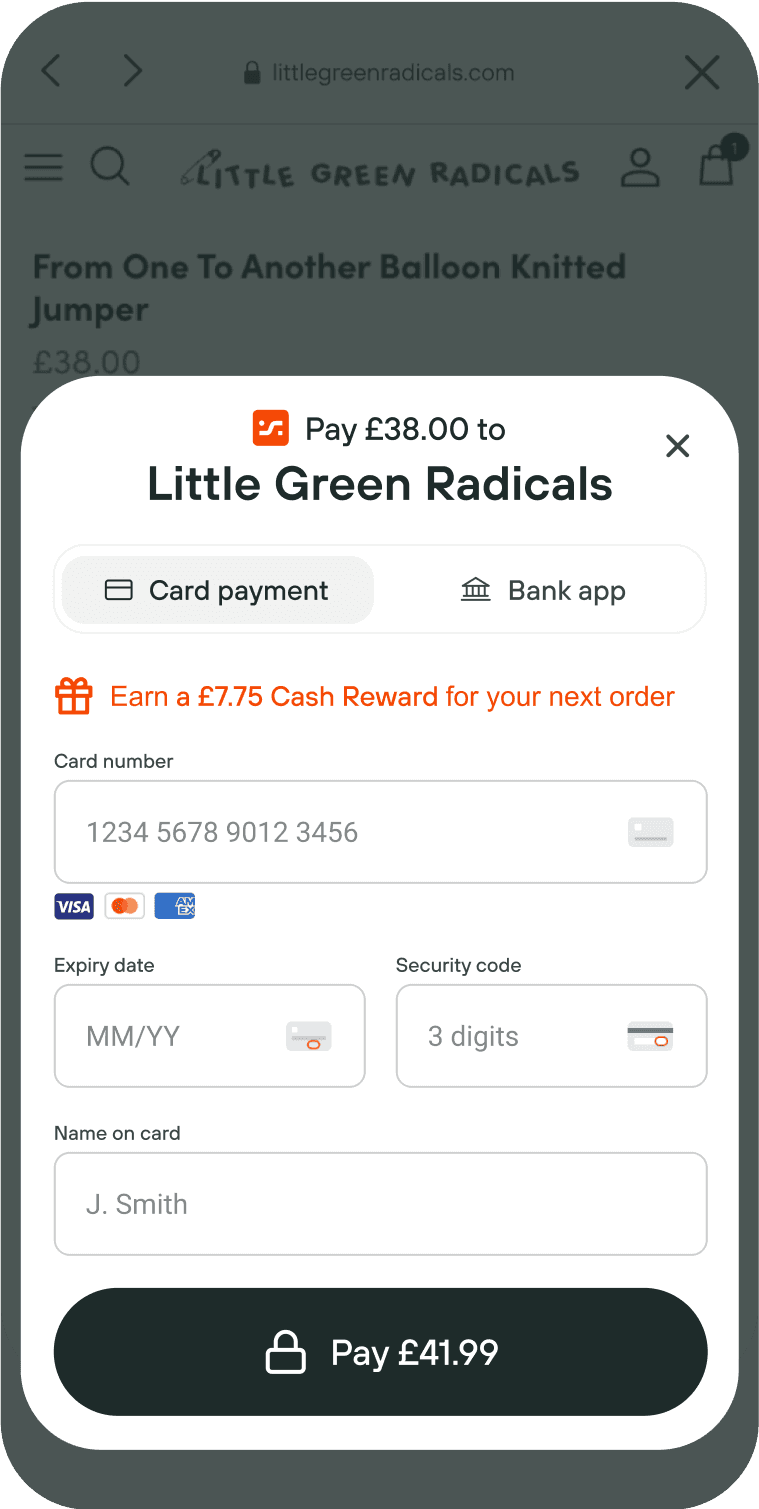

Seamless, secure checkout

Give shoppers a fast, 1-click checkout that works flawlessly on desktop and mobile. Built-in bank-level security (PCI-compliant) means trust and safety at every step, so more customers complete their purchase.

Seamless, secure checkout

Give shoppers a fast, 1-click checkout that works flawlessly on desktop and mobile. Built-in bank-level security (PCI-compliant) means trust and safety at every step, so more customers complete their purchase.

Built-in rewards

for loyalty

Every time a customer pays with Super, they earn a cash reward to spend on their next purchase at your store. This automatic perk brings customers back more often, increasing their lifetime value with no extra marketing effort from you.

Easy integration

Adding Super Payments to your website is simple. It works alongside your existing checkout and supports all major payment methods – from credit/debit cards (powered by Stripe) to instant bank payments – without any complex setup.

The Super API caters for custom ecommerce integrations. We will support your business in getting up and running with dedicated tech support.

Secure & Compliant payments

Your transactions are in safe hands with Super. We are authorized by the FCA (Financial Conduct Authority) and comply with all relevant payment regulations.

We’re partnered with Stripe and Yapily, so you’ll have world-class security and support from your very first payment.

Your transactions are in safe hands with Super. We are authorized by the FCA (Financial Conduct Authority) and comply with all relevant payment regulations.

We’re partnered with Stripe and Yapily, so you’ll have world-class security and support from your very first payment.

Read more: Super+ Fraud Prevention

Enterprise grade partnerships and security

Enterprise grade partnerships and security

Our team has delivered a seamless, secure, scalable platform that puts both merchant and consumer at the centre of everything we do.

Enterprise grade partnerships and security

Our team has delivered a seamless, secure, scalable platform that puts both merchant and consumer at the centre of everything we do.

FAQ

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?

Free payments, forever

Copyright 2025 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.

Free payments, forever

Copyright 2025 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.